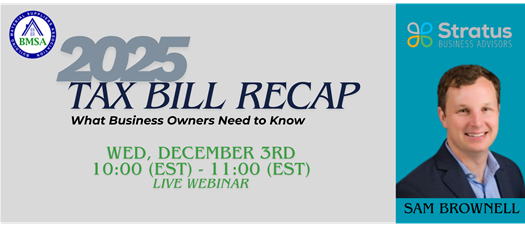

2025 Tax Bill Recap: What Business Owners Need to Know

Join Us Live

Event Details

Missed the live Summer Conference Session?

Here's your second chance!

Join us for a recap of the Summer Conference session with Sam Brownell from Stratus Business Advisors as he breaks down the most important updates from the new 2025 tax bill and what they mean for you and your business. This session is designed specifically for business owners who want practical, actionable insights to navigate the year ahead.

Topics will include:

- Updates to income tax rates

- Changes to tax, itemized and qualified business income deductions

- Estate and gift tax exemption changes

- Bonus expensing rules

- New housing tax credit provisions

- Opportunities with tax-free accounts for minors

Whether you attended in person or missed the live session, this webinar is your chance to catch up on the latest tax legislation and get insights to help you and your business plan effectively for the year ahead.

Your Instructor:

Sam Brownell, Status Business Advisors

Sam Brownell is the Founder and CEO of Stratus Business Advisors. Sam is a highly respected financial professional with nearly two decades of experience helping independent business owners and their families navigate complex financial landscapes.

He launched Stratus in 2013 with a clear mission: to deliver goals-based succession planning and financial management, particularly within the building materials industry—a sector he remains deeply committed to. As the firm grew, so did the demand for Sam’s expertise, expanding to include business owners in related industries seeking guidance on valuation, tax strategy, business continuity, and long-term planning.

Sam holds a CVA from the National Association of Certified Valuators and Analysts, is a CFA Charterholder, and earned his MBA from the University of Maryland’s Robert H. Smith School of Business. Before founding Stratus, he gained valuable experience in trading, valuation, and capital raising at two investment banks.